Consider, if you will, you want to finance a unique vehicles. In cases like this, you might lay a bit out to make a statistic that covers the cost of the auto, insurance coverage, and also other equipment. yet not a penny significantly more.

Or possibly we wish to make an application for that loan for almost all time off? Rather than requesting a lump sum, as an alternative make an application for exactly what you’ll need to protection the cost of aircraft and you can housing, then make use of the dollars you might be holding on your own right back wallet to possess spending-money.

By the credit merely what you want, you can save your self the trouble off most repayments along the lifetime of one’s financing.

Why you will be deciding on a loan provider, otherwise

The solution

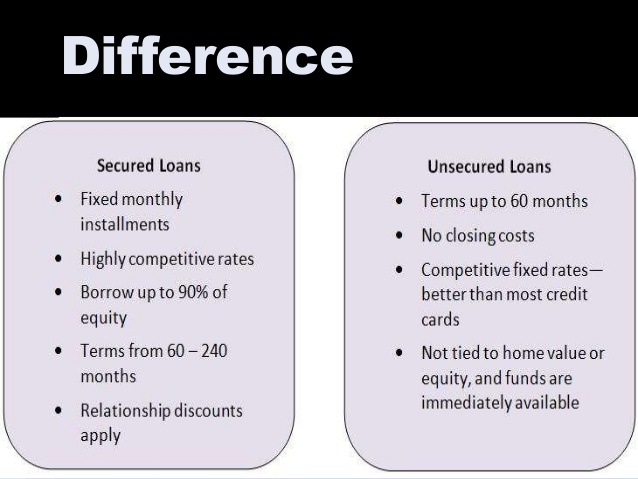

The question listed here is the best choice for your requirements? The original ones was a secured individual financing, which spends personal property such as your car given that ‘security’. In agreeing to the conditions, it is possible to often discover a much better rates.

Unsecured private money, in addition, do not require any kind away from defense. Due to the fact these are generally riskier into bank, you may be usually recharged a top rate of interest, but in replace also, they are simpler to rating.

All these carries its positives and negatives, this is why it is critical to question which is most useful to you personally, and choose one that fits you as well as your financial situation.

5. Can i be able to pay-off the money We obtain?

Sure, this may be the fresh oh-so-iconic line from Jurassic Park, nonetheless it features far more in accordance with the next application your submit to a lender than you may consider. You see, because you happen to be elligible, does not always imply you really need to apply for one to.

The answer

This may voice a tiny in reverse, it renders great monetary sense: you could borrow funds, but i have you thought if it is possible to spend they off? And can you be able to exercise easily, otherwise wouldn’t it put you significantly less than major financial be concerned and you will filters?

Before you plunge lead basic with the software process, take a seat and you can test your cash. Have a look at your budget, and you may reason for hypothetical payments. Create it simply take a large chunk from the profit? Have you thought about the interest? Whether it turns out difficult, next a loan is almost certainly not your best option at this era.

six. Carry out I’ve most of the files I wanted?

Whenever applying for personal loans, of a lot creditors requires facts about your revenue and you may expenses, your current financial predicament, and personal stats like your address and you will marital position.

Suggestions similar to this facilitate the lender to construct an image of who you really are, along with your full qualification. From this point, capable make a knowledgeable choice about how exactly far to help you provide your, therefore the rate of interest you can easily pay.

The answer

- Name and residential address

- Time regarding beginning

- Latest a career and economic advice

- Evidence of your income, in addition to payslips.

- One a great finance for combining debt, particularly, along with other costs.

This is just a picture of your information, and you may documents, you may need on the-turn in purchase to apply for individual loans. To possess reveal record, check out all of our FAQ page on the subject – Exactly what information can i get a single financing?